Public Liability Insurance for Practitioners

Avant offers public liability insurance for individual medical practitioners.

Public liability insurance for individual medical practitioners

Avant offers public liability insurance for individual medical practitioners. At Avant we understand the challenges you face as a medical practitioner are frequently changing. Increasingly, businesses are requiring practitioners to have public liability cover in addition to medical indemnity insurance.

New integrated cover for doctors

From 1 July 2025, Avant's Practitioner Indemnity Insurance policy includes public liability cover as a standard inclusion for eligible doctors.

For practitioner indemnity insurance policies renewing on or after 1 January 2026, public liability cover will be included at your next renewal.

Public liability insurance bridges a crucial gap for contractors and visiting doctors who may not be covered by a practice's insurance for public liability incidents which are separate to the healthcare provided. It covers claims and legal costs for injuries or damage occurring outside direct healthcare provision.

This differs from professional indemnity insurance, which covers claims related to professional mistakes during healthcare delivery.

Avant provides protection up to $20 million included in an Avant Practitioner Indemnity Insurance policy. This covers eligible members for third-party claims while working as a contractor or operating on a third-party premises that you don't own, lease or control.

Common scenarios include:

- A patient trips over a chair in your consulting room

- A visitor slips on a wet floor in a waiting room

- You accidentally spill liquid on a patient's electronic device

Cover is included in an Avant Practitioner Indemnity Insurance policy, for eligible members. You have cover as a contractor operating on third-party premises, meaning a location that is not owned, leased, or controlled by you. You don’t need to opt-in or pay any extra costs to have this included in your policy. The cover is noted on your policy schedule if you need to show it to your employer.

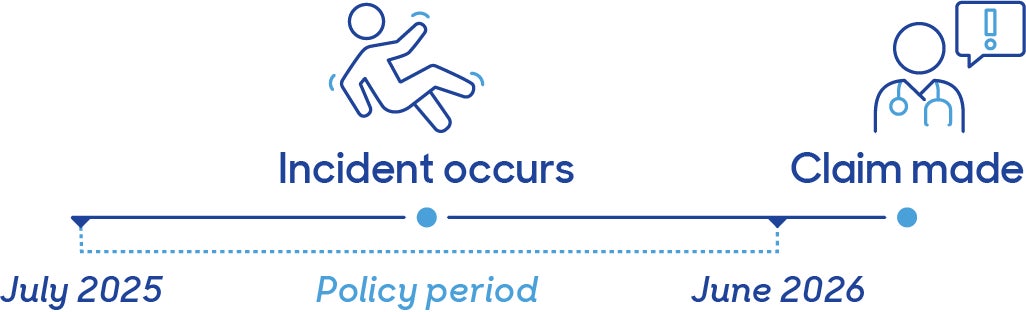

As this cover is occurrence-based, you need to have a policy in place at the time the incident occurs rather than when the claim is notified. This is different from your medical indemnity policy.

Important to note, the cover does not extend to:

- your practice entity (unless you qualify as a sole practitioner who owns and controls the practice)

- your practice staff

- incidents that occur where you provide healthcare at premises you own, lease, or control.

^Cover is subject to the full terms, conditions, and exclusions of the policy.

Many businesses require public liability insurance for doctors. If you're not directly employed by the organisation where you practise, you may need your own cover.

This is particularly important for:

- Contractors and visiting medical officers in hospitals

- Contracting surgeons performing procedures in private facilities

- General practitioners who locum or work under contract

- Specialists who consult across multiple practices

Typically required:

- When signing contracts with hospitals or clinics

- For rental agreements for consulting rooms

- When providing services at third-party locations

- For doctors who are not covered by an employer's policy

Sometimes it is written into a contract with a third party (such as a rental agreement or supply contract) that you must hold your own public liability insurance.

^Cover is subject to the full terms, conditions, and exclusions of the policy.

Avant considers you a contractor if you are a party to a contract (either written or verbal) for services with a medical practice, hospital or other healthcare provider. This includes where you engage practice management services from a medical practice as an independent practitioner.

This is a location that you do not own, lease, or control. However, if you rent or licence a room, that is covered. This also extends to universities, government buildings, schools etc.

No, this cover does not extend to cover your staff. However, you may want to consider whether you need a practice policy which can be extended to include public liability cover for your practice entity and staff.

Yes, as you lease the rooms and not the practice location you have cover under the policy for public liability if you meet the eligibility criteria.

If you own or lease the premises where you work, you may need to consider cover that is more suitable for your needs. Please contact us to learn more about our Practice and Business Insurance products. If you are not a contractor, you may not require your own public liability cover.

No, this is covered as standard in your policy without the need to opt-in.

It may depend on your situation. Please contact us at BusinessInsurance@avant.org.au for more information.

Yes, as long as the incident happened during a policy period when you held an Avant practitioner indemnity insurance policy and public liability was included on your policy schedule. This is how occurrence-based cover differs from claims-made cover.

Your public liability cover is noted on your Policy Schedule and your Confirmation Certificate if you need to show this to your employer. Please contact us if you require anything further on 1800 128 268.

Public liability insurance for practices

Avant also offers public liability cover for medical practices through both the Avant Practice Medical Indemnity and Avant Business Insurance policies. These policies can work together as complementary cover. They can help protect your practice entity, and the healthcare services you provide. They can also deliver flexibility and comprehensive protection for your whole practice. This includes cover for your practice entity, staff, and legal liabilities. Protection extends to personal injury, property damage, and advertising liability.

Policy and important documents

To view all related policy and important documents, see our Practitioner Indemnity Insurance Policy page

Professional indemnity insurance products are issued by Avant Insurance Limited (ACN 003 707 471, AFSL 238 765) (‘AIL’). The information provided by AIL is general advice only and has been prepared without taking into account your objectives, financial situation and needs. You should consider these, having regard to the appropriateness of the advice, and the relevant Product Disclosure Statement or policy wording (available at www.avant.org.au), before deciding to purchase or continue to hold these products. Practices need to consider other forms of insurance including directors’ and officers’ liability, public and products liability, property and business interruption insurance, and workers compensation.

AIL arranges Avant Business Insurance as agent of the insurer Allianz Australia Insurance Limited (ACN 000 122 850, AFSL 234 708) and may receive a commission on each policy arranged.