Medical indemnity insurance

Protect your career with Australia’s most chosen medical indemnity provider. Access the largest medico-legal team to support you at every step.

Join the largest medical defence organisation that protects over half of all doctors in Australia

Avant offers holistic support to help you practice safely and provides the expertise to defend you should something happen.

Extensive cover

Extensive cover that’s continually evolving to meet your needs and the everchanging regulatory environment.

Award-winning defence

Australia’s largest specialist medical indemnity team is recognised for its wide range of expertise. Dedicated in-house medico-legal specialists provide on-the-ground support across Australia.

Industry-leading support

Access to medico-legal experts 24/7, in emergencies, complimentary advice from the Risk Advisory Service and access to an extensive library of resources to help you practise with confidence.

Avant Medical Indemnity Insurance - A trusted partner that’s there when it matters

More than insurance. Avant stands beside doctors with expert legal defence, tailored protection, and unwavering support, so you can focus on delivering exceptional care.

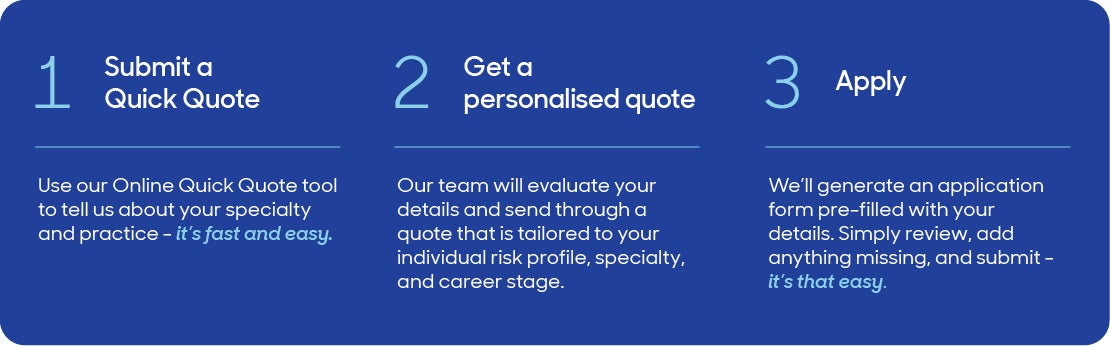

Protect your career in 3 easy steps

With Avant, getting protected is simple. Whether you're changing indemnity provider or reviewing your options this EOFY, it only takes a few minutes to get started.

Cover tailored to your career stage

With our range of medical indemnity policies, we're by your side every step of your medical career.

Medico-legal Advisory Service

Access to caring expert advice whenever you need it, staffed by a medico-legal team including solicitors and doctors, from across the country.

Avant Law Medical Indemnity

Support from Australia’s largest medical indemnity team with specialists in every relevant area of law, if you are subject to a claim or complaint.

Getting Started in Private Practice Program

Get a four-year boost when you start in private practice. Save up to 80% off the cost of your professional indemnity premium.

Loyalty Reward Plan

An industry first program that offers discounts on medical indemnity premiums. Rewarding members for their loyalty.

Retirement Reward Plan

Avant Retirement Reward Plan is one way we share our financial success with members.

Medical advisers directory

Avant has a diverse team of state-based, nationally integrated medical advisers to provide peer support to our members and assist with the clinical understanding of claims.

Premium Support Scheme

The Premium Support Scheme is an Australian Government scheme that helps you with the costs of your medical indemnity insurance.

Public Liability Cover for eligible members

Avant Practitioner Indemnity Insurance policy now includes cover against third-party claims while working as a contractor or operating on a premises that you don't own or lease.

What you are covered for^

With an Avant Practitioner Indemnity policy, you can practise with confidence knowing you have the protection. Extensive cover that’s continually evolving to meet your needs and the everchanging regulatory environment, and covers your for:

- Civil liability claims

- Disciplinary matters

- Medicare investigations and audits

- Coronial inquests and investigations

- Hospital inquiries

- Third-party public liability claims (for eligible members)

View policy and coverage:

^Cover is subject to the full terms, conditions, and exclusions of the policy.

Factors that influence policy premiums

Individual factors

Includes work a member does in their professional practice and excludes work outside of this. While medical indemnity insurance takes individual circumstances into account, it also considerers claims in their cohort. As a rule, the higher risk the healthcare, the more a member can expect to pay for their medical indemnity cover.

Includes income generated by a member from their practise and reflects the number of private patients they see and the type and volume of healthcare services they provide. It is likely gross private billings will change as a member progresses through their career.

Includes personal liabilities that may arise from members' provision of healthcare by way of civil claims and non-civil claims. Medical indemnity insurance is a claims-made policy, which means doctors are covered for incidents from their past healthcare and claims made against them by patients and other third parties when the claim is made and not when the incident occurred.

Industry factors

Social inflation, resulting from increasing litigation and costs, is driving the increasing cost of claims. Litigation funding and legislative changes also impact the cost of claims.

Includes inflation pressure on the cost of claims and operating expenses. These pressures increase the cost of claims and are built into the claims settlement calculations.

There has been a steady increase in demand for medico-legal advice in recent years, and over the last 12 months, our team responded to more than 30,000 calls.*

*As of 30 June 2023

PDS and policy documents

As an Avant member, please refer to the relevant Product Disclosure Statement and Policy Wording, Category of Practice Guide and your policy schedule for the details of your cover. We encourage you to familiarise yourself with the terms, conditions and exclusions, and your rights and obligations that apply to your policy.

View policy and coverage:

^Cover is subject to the full terms, conditions, and exclusions of the policy.

I have been an Avant member for many years, valuing Avant’s experience in the field and being a member of a large, safe organisation, with a lot of expertise and resources.

"To apply for Avant's practitioner membership simply visit our practitioner policy page and complete the online application form. Alternatively, you can download the interactive PDF application form from the website, contact member services or email Avant to request an application form.

To notify us of an incident, please complete and submit the Medico-legal notification. To learn more about notifications, or making a claim on your indemnity policy, visit medico-legal notifications and assistance.